Diving into the world of Understanding payday loans, get ready to explore the ins and outs of this financial tool in a way that’s both informative and captivating.

Get ready to uncover the mysteries behind payday loans and how they impact individuals’ financial well-being.

What are payday loans?

Payday loans are short-term, high-interest loans that are typically due on the borrower’s next payday. These loans are designed to provide quick cash to individuals facing unexpected financial emergencies.

Concept of payday loans

- Payday loans are usually for small amounts, ranging from $100 to $1000.

- Borrowers are required to repay the loan in full, plus fees, by their next payday.

- These loans are often easy to access with minimal credit requirements, making them appealing to individuals with poor credit scores.

Typical features of payday loans

- High interest rates: Payday loans have extremely high APRs, sometimes reaching up to 400%.

- Short repayment term: Borrowers typically have to repay the loan within 2 to 4 weeks.

- Quick approval process: Payday loans are known for their fast approval, with funds often deposited into the borrower’s account within 24 hours.

Examples of situations where people might consider taking out a payday loan

- Emergency medical expenses

- Car repairs

- Utility bills

How do payday loans work?

When it comes to payday loans, the process is quite simple but can have serious financial implications if not managed properly. These short-term loans are typically small-dollar amounts borrowed for a short period, usually until the borrower’s next payday.

Obtaining a payday loan

- First, the borrower must provide proof of income and identification to the payday lender.

- Then, the borrower writes a post-dated check for the amount borrowed plus fees, or authorizes an electronic debit from their bank account on the due date.

- The borrower receives the loan amount in cash or deposited into their bank account.

Repayment terms and conditions

- Payday loans are typically due on the borrower’s next payday, usually within 2 weeks to a month.

- If the borrower cannot repay the loan in full, they may have the option to roll over the loan by paying additional fees to extend the due date.

- Failure to repay the loan on time can result in additional fees, collection calls, and damage to the borrower’s credit score.

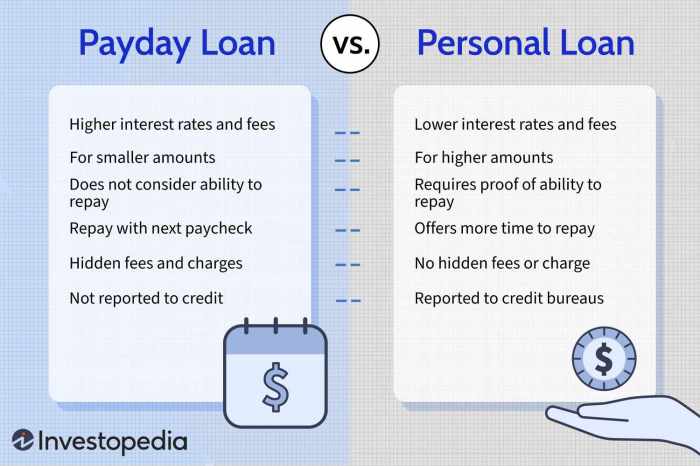

Comparison of interest rates

Payday loans are known for their high interest rates, which can range from 300% to 500% APR or even higher. In contrast, traditional bank loans typically have much lower interest rates, usually ranging from 5% to 36% APR. It’s essential to consider the cost of borrowing when deciding between a payday loan and a traditional bank loan to avoid falling into a debt trap.

Pros and cons of payday loans

When it comes to payday loans, there are both advantages and disadvantages to consider. Let’s break down the pros and cons below.

Advantages of payday loans for borrowers

- Quick access to cash: Payday loans provide borrowers with immediate funds to cover unexpected expenses or emergencies.

- No credit check: Unlike traditional loans, payday lenders typically do not require a credit check, making it easier for individuals with poor credit to qualify.

- Convenience: The application process for payday loans is usually quick and straightforward, requiring minimal documentation.

- Flexibility: Borrowers can use payday loan funds for any purpose, giving them the flexibility to address various financial needs.

Disadvantages or risks associated with payday loans

- High interest rates: Payday loans often come with extremely high interest rates, making them a costly borrowing option.

- Debt cycle: Due to the short repayment terms and high fees, borrowers may find themselves trapped in a cycle of debt if they cannot repay the loan on time.

- Impact on credit score: Defaulting on a payday loan can negatively impact a borrower’s credit score and financial future.

- Aggressive collection practices: Some payday lenders use aggressive tactics to collect overdue payments, causing stress and financial strain for borrowers.

Examples of when using a payday loan might be beneficial or harmful

- Beneficial: A borrower needs immediate funds to cover a medical emergency and does not have access to other forms of credit.

- Harmful: A borrower takes out a payday loan to cover regular expenses and becomes reliant on this form of borrowing to make ends meet.

Understanding the impact of payday loans

When considering the impact of payday loans on individuals, it is crucial to analyze how these short-term, high-interest loans can affect their financial situations. These loans are often used by individuals facing financial emergencies or cash shortages, but the consequences of relying on payday loans can be significant.

Analyze the impact of payday loans on individuals’ financial situations

- Payday loans can lead to a cycle of debt due to their high interest rates and short repayment terms.

- Borrowers may find themselves unable to repay the loan in full by the due date, leading to additional fees and charges.

- Defaulting on a payday loan can result in damage to credit scores and financial stability.

Discuss the potential cycle of debt that can result from relying on payday loans

- Individuals who repeatedly take out payday loans may find themselves trapped in a cycle of borrowing to cover previous loans.

- This cycle can lead to a continuous cycle of debt accumulation, making it challenging to break free from the payday loan trap.

- The high costs associated with payday loans can exacerbate financial struggles and create long-term financial hardship.

Explore alternatives to payday loans for managing financial emergencies

- Building an emergency fund can provide a financial safety net for unexpected expenses without the need for high-cost loans.

- Seeking assistance from non-profit credit counseling services can help individuals develop a plan to manage their finances and avoid payday loans.

- Exploring options such as personal loans from banks or credit unions, or negotiating with creditors for extended payment terms, can offer more affordable alternatives to payday loans.