Get ready to dive into the world of credit scores, where numbers hold the key to financial success or failure. From unraveling the secrets behind credit scoring to mastering the art of boosting your score, this journey will equip you with the knowledge needed to navigate the complex world of credit.

What is a credit score?

A credit score is a numerical representation of an individual’s creditworthiness, which indicates the likelihood of repaying borrowed money. It is used by lenders to determine the risk associated with providing credit to a person.

Factors affecting credit scores

- Payment history: Timely payments on credit accounts.

- Amounts owed: Total debt and credit utilization ratio.

- Length of credit history: How long accounts have been open.

- New credit: Recent credit inquiries and accounts opened.

- Credit mix: Variety of credit accounts like credit cards, loans, etc.

Importance of having a good credit score

Having a good credit score is crucial for various financial transactions, such as obtaining loans, credit cards, mortgages, and even influencing interest rates. A higher credit score can lead to better terms and lower costs when borrowing money.

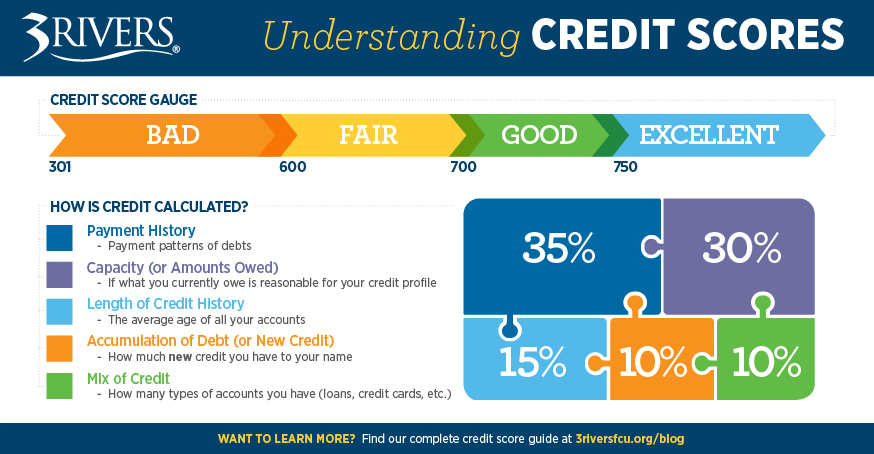

How are credit scores calculated?

When it comes to calculating credit scores, several key components play a crucial role in determining an individual’s overall creditworthiness. These components are used by credit bureaus to generate a numerical representation of a person’s credit history and financial behavior.

Components of a Credit Score

- Payment history: This is the most significant factor, accounting for approximately 35% of your credit score. It reflects whether you have paid your bills on time and if you have any late payments or defaults.

- Amounts owed: This component makes up about 30% of your credit score and considers the total amount of debt you owe, including credit card balances, loans, and other lines of credit.

- Length of credit history: Your credit history’s length contributes around 15% to your credit score. It takes into account how long you have been using credit and the age of your accounts.

- Credit mix: The variety of credit accounts you have, such as credit cards, mortgages, and loans, impacts about 10% of your credit score.

- New credit: Opening multiple new credit accounts within a short period can lower your credit score, as it makes up approximately 10% of the total score.

Credit Score Ranges and Significance

Most credit scores range from 300 to 850, with higher scores indicating better creditworthiness. Here’s a general breakdown:

- 300-579: Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very Good

- 800-850: Excellent

Impact of Late Payments on Credit Scores

Late payments can have a significant negative impact on your credit score. They can stay on your credit report for up to seven years and lower your score, making it harder to qualify for loans, credit cards, or favorable interest rates. It’s essential to make payments on time to maintain a good credit score and financial health.

Ways to improve your credit score

Improving your credit score is crucial for financial stability and future opportunities. By following these tips, you can boost your credit score and open doors to better financial options.

Timely Payments

One of the most important factors in improving your credit score is making timely payments on all your credit accounts. Late payments can significantly impact your score, so be sure to pay your bills on time each month.

Credit Utilization

Credit utilization refers to the amount of credit you are using compared to the total amount of credit available to you. Keeping your credit utilization low, ideally below 30%, can help maintain a good credit score. Make sure to regularly monitor your credit card balances and try to pay them off in full each month.

Understanding the importance of credit monitoring

Regularly monitoring your credit score is crucial for maintaining financial health and security. By keeping a close eye on your credit report, you can detect any suspicious activity, errors, or signs of identity theft early on, allowing you to take action promptly.

Benefits of monitoring your credit score regularly

- Identify and correct any errors on your credit report that could be negatively impacting your score.

- Monitor your financial progress and track improvements in your credit score over time.

- Stay informed about any unauthorized activity or potential signs of identity theft.

- Prepare yourself for major financial decisions, such as applying for a loan or mortgage.

How credit monitoring services work

- Credit monitoring services keep a constant watch on your credit report and alert you to any changes or suspicious activity.

- These services often provide credit score updates, credit report monitoring, and alerts for any new accounts opened in your name.

- Some services also offer identity theft insurance and assistance in case you become a victim of identity theft.

Impact of identity theft on credit scores

Identity theft can have a devastating impact on your credit score and overall financial well-being. When someone steals your personal information and misuses it to open fraudulent accounts or make unauthorized purchases, it can lead to a significant decrease in your credit score. This can make it difficult for you to obtain credit, loans, or mortgages in the future. By monitoring your credit regularly, you can detect and address identity theft issues promptly, minimizing the damage to your credit score.

How to check your credit score

Checking your credit score is an important step in managing your financial health. It allows you to track your progress and identify areas for improvement. Here’s how you can check your credit score:

Online Services

- Sign up for a free account with a reputable credit monitoring service like Credit Karma or Credit Sesame.

- Enter your personal information and verify your identity.

- View your credit score and detailed credit report online.

Credit Card Statements

- Some credit card companies offer free credit score updates on your monthly statements.

- Check your latest statement to see if your credit score is included.

- Keep in mind that not all credit card companies provide this service.

Annual Credit Report

- Visit AnnualCreditReport.com to request a free credit report from each of the three major credit bureaus.

- Review your credit report for any errors or discrepancies that could be affecting your credit score.

- While this report does not include your credit score, it is a valuable tool for monitoring your credit history.

Remember, it’s important to check your credit score regularly to catch any fraudulent activity or errors that could harm your credit.