When it comes to investing, mutual funds and ETFs stand out as popular choices for many investors. But what sets them apart? Let’s dive into the world of mutual funds vs ETFs, exploring their differences, benefits, and how they can impact your investment strategy.

From the structure and operation to the costs and fees, tax efficiency, investment options, diversification, trading, and liquidity – we’ll break down everything you need to know to make informed decisions about your investments.

Introduction

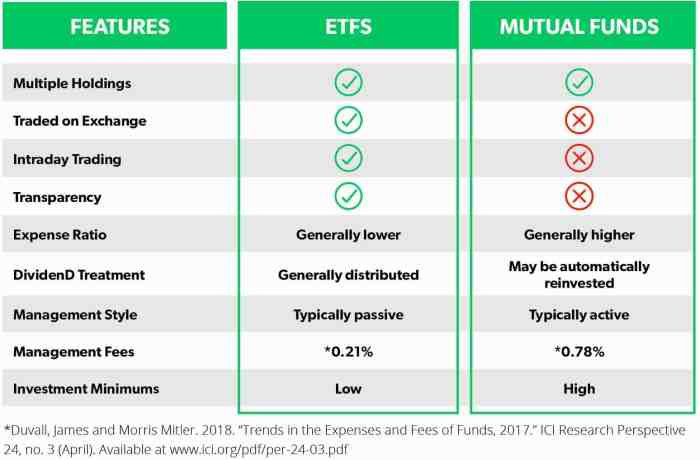

Mutual funds and ETFs are both investment options that allow individuals to pool their money together to invest in a diversified portfolio of stocks, bonds, or other securities. The key difference between mutual funds and ETFs lies in how they are bought and sold. Mutual funds are bought or sold directly from the fund company at the end of the trading day at the net asset value (NAV), while ETFs are traded on the stock exchange throughout the day like individual stocks.

In recent years, both mutual funds and ETFs have gained popularity among investors looking for diversified investment options with varying levels of risk. The growth of ETFs has been particularly notable due to their lower expense ratios and tax efficiency compared to traditional mutual funds.

Structure and Operation

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of securities, such as stocks, bonds, or other assets. This pooling of funds allows individual investors to access a professionally managed portfolio that they might not be able to afford on their own.

Structure of Mutual Funds

Mutual funds are managed by professional fund managers who make investment decisions on behalf of the investors. These fund managers are responsible for selecting the securities to be included in the fund’s portfolio, based on the fund’s investment objectives. Investors in mutual funds own shares of the fund, which represent their proportional ownership of the fund’s assets.

Operational Differences

One key operational difference between mutual funds and ETFs is the way they are traded. Mutual funds are priced at the end of the trading day based on the net asset value (NAV) of the fund, which is calculated using the closing prices of the securities in the fund’s portfolio. In contrast, ETFs trade on an exchange throughout the day like stocks, and their prices may fluctuate based on supply and demand in the market.

Role of Fund Managers and Creation/Redemption Process

Fund managers play a crucial role in mutual funds by conducting research, making investment decisions, and managing the fund’s portfolio to achieve its investment objectives. In contrast, the creation and redemption process in ETFs involves authorized participants who can create or redeem shares of the ETF directly with the fund manager. This process helps maintain the ETF’s price close to its net asset value.

Cost and Fees

When it comes to investing in mutual funds and ETFs, understanding the cost and fees associated with each is crucial for maximizing your returns and achieving your financial goals. Let’s break down the cost structures of mutual funds and ETFs, and analyze how these fees can impact your overall investment returns.

Expense Ratios and Trading Fees

Expense ratios play a significant role in determining the cost of investing in mutual funds and ETFs. These ratios represent the percentage of a fund’s assets that are used to cover operating expenses, such as management fees, administrative costs, and other overhead expenses. Generally, mutual funds tend to have higher expense ratios compared to ETFs, as they involve more active management and research.

On the other hand, ETFs typically have lower expense ratios due to their passive management style, which aims to track a specific index or asset class. This difference in expense ratios can directly impact your investment returns over time. For example, if you invest $10,000 in a mutual fund with an expense ratio of 1%, you would pay $100 in fees annually. In comparison, investing the same amount in an ETF with a 0.5% expense ratio would result in $50 in annual fees.

In addition to expense ratios, investors should also consider trading fees when comparing mutual funds and ETFs. Mutual funds may charge sales loads, redemption fees, or transaction fees when buying or selling shares, which can eat into your investment returns. On the other hand, ETFs are traded on stock exchanges like individual stocks, which may involve brokerage commissions but typically have lower trading costs compared to mutual funds.

Overall, understanding the impact of expense ratios and trading fees on your investment returns is essential for making informed decisions when choosing between mutual funds and ETFs. By carefully comparing the cost structures of each investment option, you can optimize your portfolio’s performance and minimize unnecessary fees.

Tax Efficiency

When it comes to tax efficiency, both mutual funds and ETFs have some key differences that investors should consider before making a decision.

Capital Gains Distributions

In mutual funds, capital gains distributions are typically made annually to shareholders. This means that investors may be subject to taxes on these distributions, even if they did not sell any shares of the fund themselves. On the other hand, ETFs are structured in a way that allows for more tax efficiency. Since ETFs are bought and sold on an exchange like a stock, investors have more control over when they realize capital gains. This can help reduce the tax burden for ETF investors compared to mutual fund investors.

Tax Advantages of ETFs

One of the key tax advantages of ETFs over mutual funds is the ability to minimize capital gains taxes. Because of the way ETFs are structured and traded, investors have more flexibility in managing their capital gains. Additionally, ETFs tend to have lower portfolio turnover compared to mutual funds, which can lead to fewer capital gains distributions and potentially lower tax liabilities for investors. Overall, the tax efficiency of ETFs can be a major benefit for investors looking to minimize their tax burden while investing in the market.

Investment Options and Diversification

When it comes to investment options and diversification, both mutual funds and ETFs offer investors a way to spread their money across a wide range of assets. This helps reduce risk and exposure to any single investment.

Diversified Investment Options

- Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. This allows investors to access a variety of investments through a single fund.

- ETFs, like mutual funds, provide investors with exposure to a diversified portfolio of assets. However, ETFs are traded on exchanges like stocks, offering more flexibility in buying and selling throughout the trading day.

Flexibility in Investment Choices

- Mutual funds generally have restrictions on when investors can buy or sell shares, typically only at the end of the trading day. This can limit the flexibility of investors looking to make quick investment decisions.

- ETFs, on the other hand, can be bought and sold throughout the trading day at market prices. This flexibility allows investors to react quickly to market changes and adjust their investment strategies accordingly.

Access to Various Asset Classes and Sectors

- Both mutual funds and ETFs offer investors access to a wide range of asset classes, including stocks, bonds, commodities, and real estate. This allows investors to diversify their portfolios across different sectors and industries.

- ETFs may provide more targeted exposure to specific sectors or industries through specialized funds, giving investors the opportunity to focus on areas of the market they believe will perform well.

Trading and Liquidity

When it comes to trading mutual funds and ETFs, there are some key differences to consider. One major distinction is the way these investments are bought and sold, which can impact liquidity.

Intraday Trading and Pricing

Intraday trading refers to buying and selling securities within the same trading day. While ETFs can be traded throughout the day on an exchange like stocks, mutual funds are only traded at the end of the trading day at their net asset value (NAV). This means that mutual fund investors may not be able to take advantage of intraday price movements like ETF investors can.

Liquidity Variation

ETFs typically have higher liquidity compared to mutual funds due to their ability to be traded intraday. This means that ETF investors can quickly buy or sell shares at market price during trading hours. On the other hand, mutual funds can only be bought or sold at the end of the trading day, which may result in less liquidity and potentially higher transaction costs.

Impact of Trading Volumes and Market Conditions

The liquidity of both mutual funds and ETFs can be influenced by trading volumes and market conditions. Higher trading volumes usually lead to increased liquidity as there are more buyers and sellers in the market. However, during volatile market conditions, liquidity can decrease as investors may be reluctant to trade. It’s important for investors to consider these factors when choosing between mutual funds and ETFs based on their liquidity needs.