Yo, let’s talk about investing in emerging markets. It’s like diving into a whole new world of opportunities and risks, where the game is high stakes and the rewards can be off the charts. So buckle up and get ready for a wild ride through the ins and outs of this financial adventure.

As we delve deeper, we’ll uncover the secrets to success and the pitfalls to avoid when navigating the realm of emerging markets.

Overview of Emerging Markets

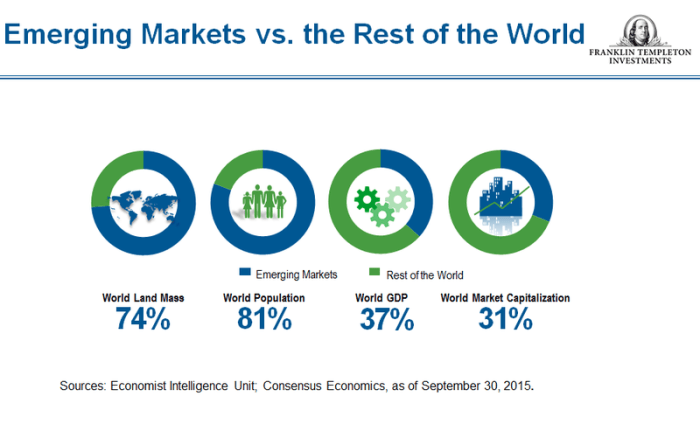

Emerging markets refer to countries with developing economies that show strong growth potential and offer investment opportunities for investors looking for higher returns. These markets are characterized by rapid industrialization, urbanization, and technological advancements.

Key Characteristics of Emerging Markets

- High economic growth rates: Emerging markets often experience faster economic growth compared to developed countries.

- Youthful population: These countries typically have a young and growing population, which can drive consumer demand and economic growth.

- Improving infrastructure: Emerging markets are investing in infrastructure development to support their growing economies.

- Market liberalization: Many emerging markets are opening up their economies to foreign investment and trade.

- Higher volatility: Investments in emerging markets can be more volatile due to political instability, currency fluctuations, and regulatory changes.

Examples of Emerging Markets

- China: The world’s second-largest economy, China is a major player in the global market with rapid industrialization and urbanization.

- India: With a large and young population, India offers significant growth opportunities in various sectors such as technology, healthcare, and consumer goods.

- Brazil: Known for its natural resources and agricultural sector, Brazil is a key player in the Latin American market.

- Russia: Rich in natural resources, Russia has a diverse economy with opportunities in sectors like energy, mining, and technology.

- South Africa: A leading economy in Africa, South Africa offers opportunities in mining, finance, and tourism sectors.

Benefits of Investing in Emerging Markets

Investing in emerging markets can offer numerous advantages for investors looking to diversify their portfolios and potentially earn high returns compared to developed markets.

High Returns Potential

Emerging markets often have higher growth rates compared to developed markets, providing investors with the opportunity to earn significant returns on their investments. These markets can experience rapid economic expansion, leading to increased profitability for companies operating within them.

Diversification Opportunities

Investing in emerging markets allows investors to diversify their portfolios beyond traditional investments in developed markets. By spreading investments across different regions and industries, investors can reduce their overall risk exposure and potentially benefit from the growth of diverse economies.

Risks Associated with Investing in Emerging Markets

Investing in emerging markets can offer high potential returns, but it also comes with its fair share of risks. These risks can be significantly different from those in developed markets, making it crucial for investors to understand and manage them effectively.

Political Risks

Political instability, corruption, and changes in government policies can greatly impact investments in emerging markets. This can lead to sudden regulatory changes, expropriation of assets, or even civil unrest, creating uncertainties for investors.

Economic Risks

Emerging markets are more susceptible to economic downturns and fluctuations due to factors like inflation, high debt levels, and limited access to credit. Currency devaluation and fluctuating interest rates can also pose significant risks to investments.

Currency Risks

Currency risk is a major concern when investing in emerging markets, as exchange rate fluctuations can directly impact the value of investments. Sudden depreciation of the local currency can erode returns for foreign investors, leading to potential losses.

Strategies for Investing in Emerging Markets

Investing in emerging markets can be lucrative, but it comes with its own set of challenges. To navigate these waters successfully, investors need to adopt the right strategies to maximize their returns and mitigate risks.

Diversification

Diversifying your investment portfolio is crucial when investing in emerging markets. Spread your investments across different countries, industries, and asset classes to reduce the impact of any single event on your overall portfolio.

- Invest in a mix of equities, bonds, and alternative assets to minimize risk.

- Consider investing in emerging market index funds or exchange-traded funds (ETFs) for broad exposure.

- Explore different sectors such as technology, healthcare, or consumer goods to capitalize on growth opportunities.

Long-Term Perspective

Taking a long-term perspective is key when investing in emerging markets. Economic and political conditions in these markets can be volatile, so it’s important to have a horizon of at least 5-10 years to ride out any short-term fluctuations.

- Focus on companies with strong fundamentals and growth potential for sustainable returns over time.

- Avoid making knee-jerk reactions to market volatility and stick to your investment plan.

- Regularly review and rebalance your portfolio to ensure it aligns with your long-term goals.

Risk Management

Managing risks effectively is essential for successful investing in emerging markets. While higher returns are possible, the volatility and uncertainty in these markets require a proactive approach to risk management.

- Use stop-loss orders to limit potential losses and protect your capital.

- Stay informed about geopolitical events, economic indicators, and regulatory changes that could impact your investments.

- Consider working with a financial advisor who specializes in emerging markets to get expert guidance on risk management strategies.

Sectors and Industries in Emerging Markets

Emerging markets present a wide array of sectors and industries that offer unique opportunities for investors looking to diversify their portfolios and capitalize on growth potential.

Technology Sector

The technology sector in emerging markets is experiencing rapid growth, driven by increasing internet penetration and the adoption of digital technologies. Countries like India and China have thriving tech industries, with companies like Alibaba and Tencent leading the way in innovation and market expansion.

Healthcare Industry

The healthcare industry in emerging markets is poised for substantial growth due to rising middle-class populations and increased healthcare spending. Companies involved in pharmaceuticals, medical devices, and healthcare services are expected to benefit from this trend, with opportunities for expansion and investment in regions like Latin America and Southeast Asia.

Consumer Goods Sector

The consumer goods sector in emerging markets is a key area of focus for investors, as rising incomes and changing consumer preferences drive demand for a wide range of products. From FMCG companies to retail giants, there are significant growth opportunities in sectors like food and beverages, personal care, and household products.

Renewable Energy Industry

The renewable energy industry is gaining traction in emerging markets as governments and businesses seek sustainable energy solutions. Solar, wind, and hydroelectric power projects are on the rise, offering investment opportunities in countries like Brazil, South Africa, and India. Challenges related to regulatory frameworks and infrastructure development may impact the growth potential in this sector.