Yo, listen up! We’re diving into the crucial world of saving early, where financial stability meets compound interest and long-term goals. Get ready for some money wisdom!

Now, let’s break it down for ya so you can understand the power of starting early when it comes to saving those Benjamins.

Importance of Saving Early

Saving early is like planting a money tree that grows over time, providing shade in the form of financial stability. When you start saving from a young age, you set yourself up for a brighter financial future.

Benefits of Compound Interest

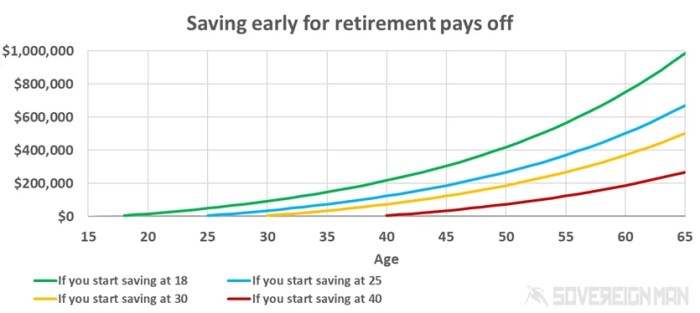

Compound interest is like a secret superpower that works in your favor when you save money early. It’s like earning interest on your interest, helping your savings grow faster than you could imagine. The earlier you start saving, the more time your money has to compound and grow exponentially.

Achieving Long-term Financial Goals

Early saving is the key to unlocking your long-term financial dreams. Whether you’re saving for a dream home, retirement, or a once-in-a-lifetime vacation, starting early gives you a head start. It allows you to build a solid financial foundation that can support your goals and aspirations down the road.

Financial Literacy Education

Educating young individuals about the importance of saving money is crucial in building a strong financial foundation for the future. By instilling good saving habits early on, children and teens can develop a mindset that values financial security and long-term planning.

Teaching Strategies for Schools and Parents

- Schools can incorporate financial literacy lessons into their curriculum, teaching students about budgeting, saving, and investing.

- Parents can lead by example, involving children in family financial discussions and setting up savings accounts for them.

- Interactive activities like budgeting games and simulations can make learning about money management fun and engaging for young learners.

Financial Outcomes of Early Savers vs. Non-Savers

- Individuals who start saving early tend to have more financial stability and security later in life.

- Early savers are better prepared for emergencies and unexpected expenses, reducing financial stress.

- Those who delay saving may struggle to catch up later, missing out on the benefits of compound interest and long-term investment growth.

Setting Financial Goals

Setting specific saving goals is crucial in motivating individuals to start saving early. By having clear objectives, people are more likely to stay committed to saving and track their progress towards financial stability.

Types of Financial Goals

- Emergency Funds: Setting aside money for unexpected expenses like medical bills or car repairs can provide a safety net during tough times.

- Retirement Savings: Planning for retirement early ensures a comfortable and stress-free future without relying solely on social security benefits.

- Investment Goals: Investing in assets like stocks, bonds, or real estate can help grow wealth and achieve long-term financial growth.

Creating a Realistic Savings Plan

- Assess Your Current Financial Situation: Calculate your income, expenses, and debts to determine how much you can realistically save each month.

- Set Specific Goals: Define the amount you want to save for each goal and create a timeline for achieving them.

- Automate Savings: Use automatic transfers to divert a portion of your income directly into savings accounts dedicated to each goal.

- Track Your Progress: Regularly review your savings plan to ensure you are on track to meet your goals and make adjustments as needed.

- Stay Disciplined: Avoid unnecessary expenses and stay focused on your goals to maintain financial discipline and achieve success.

Risk Management and Emergency Funds

In the world of financial planning, one crucial aspect to consider is risk management and the importance of having emergency funds. Let’s delve into why having a safety net for unexpected expenses is key and explore strategies for building an emergency fund.

Role of Emergency Funds

Emergency funds serve as a financial cushion to help individuals weather unexpected expenses or income disruptions without derailing their overall financial health. These funds act as a safety net, providing peace of mind and stability during challenging times.

Importance of Having a Safety Net

- Protecting Against Unforeseen Circumstances: Life is unpredictable, and having an emergency fund can help cover sudden medical expenses, car repairs, or job loss without resorting to high-interest debt.

- Reducing Financial Stress: Knowing you have a safety net in place can alleviate anxiety about potential emergencies, allowing you to focus on other financial goals.

Strategies for Building an Emergency Fund

- Set Clear Savings Goals: Determine how much you want to save for emergencies, whether it’s three to six months’ worth of living expenses or a specific amount.

- Automate Savings: Set up automatic transfers from your checking account to a separate savings account designated for emergencies to ensure consistent contributions.

- Cut Unnecessary Expenses: Evaluate your spending habits and identify areas where you can cut back to redirect funds towards your emergency fund.

- Consider High-Yield Savings Accounts: Explore savings options that offer higher interest rates to help your emergency fund grow faster over time.