Get ready to dive into the world of credit scores and loans with a focus on how they intersect and impact each other. From loan approval rates to interest rates, we’ll cover it all in a way that keeps you hooked.

Let’s break down the key aspects of credit scores and loans, unveiling the importance of creditworthiness in the financial realm.

Impact of credit scores on loan approval

Having a good credit score is crucial when it comes to getting approved for a loan. Lenders use your credit score to assess your creditworthiness and determine the risk of lending to you. Here’s how credit scores influence the approval process for loans:

How credit scores influence loan approval

- Lenders rely on credit scores to gauge the likelihood of borrowers repaying their loans on time.

- Higher credit scores indicate a history of responsible financial behavior, making borrowers more attractive to lenders.

- Lower credit scores may lead to higher interest rates or even loan denial due to perceived risk.

Examples of credit score ranges affecting loan approval rates

- A credit score of 750 and above usually qualifies for the best loan terms and rates.

- A credit score between 600-700 may still secure a loan, but with higher interest rates.

- A credit score below 500 can significantly limit loan options and result in rejection from many lenders.

Importance of credit scores in determining interest rates

- Borrowers with higher credit scores are offered lower interest rates because they are considered less risky.

- Conversely, borrowers with lower credit scores may face higher interest rates to offset the perceived risk of default.

- Improving your credit score can lead to better loan terms and lower interest rates, saving you money in the long run.

Factors affecting credit scores

When it comes to credit scores, several key factors can have a significant impact on your overall score. These factors play a crucial role in determining your creditworthiness and can affect your ability to secure loans or credit cards.

Payment history

Your payment history is one of the most important factors that influence your credit score. This includes how consistently you make on-time payments for your credit card bills, loans, and other financial obligations. Late payments, defaults, or accounts in collections can all have a negative impact on your credit score. On the other hand, a history of timely payments can help boost your score and demonstrate your reliability as a borrower.

Credit utilization

Credit utilization refers to the percentage of your available credit that you are currently using. Keeping this ratio low, ideally below 30%, can positively impact your credit score. High credit utilization suggests that you may be relying too heavily on credit and could be at risk of overextending yourself financially. Lenders view lower credit utilization as a sign of responsible credit management and may view you more favorably when assessing your creditworthiness.

Types of loans influenced by credit scores

Credit scores play a significant role in determining the approval and terms of various types of loans. Lenders use credit scores to assess the risk of lending money to borrowers, which impacts the interest rates, loan amounts, and repayment terms offered.

Types of loans requiring higher credit scores

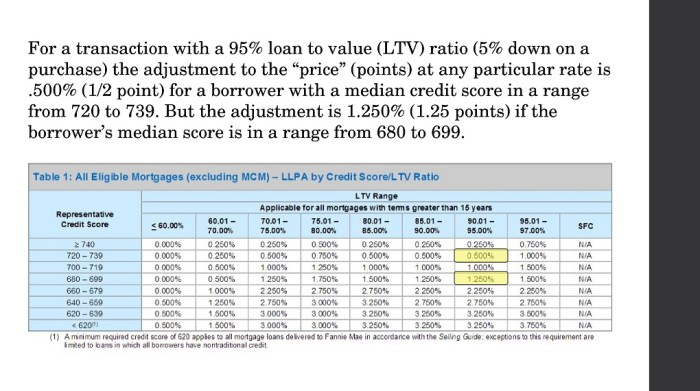

- Mortgages: Mortgage lenders typically require higher credit scores to approve home loans. Borrowers with higher credit scores are more likely to qualify for lower interest rates and better terms.

- Personal Loans: Unsecured personal loans may require higher credit scores as they are not backed by collateral. A good credit score can help secure a lower interest rate.

- Auto Loans: Car loans may also require a certain credit score for approval. Higher credit scores can lead to better interest rates and loan options.

Impact of credit scores on loan terms

- Interest Rates: Borrowers with higher credit scores are often offered lower interest rates, resulting in lower overall loan costs.

- Loan Amounts: Higher credit scores can increase the likelihood of approval for larger loan amounts, as lenders perceive lower risk with a strong credit history.

- Repayment Terms: Credit scores can influence the repayment terms of loans, such as the length of the loan and any additional fees or penalties imposed.

Strategies to improve credit scores for loan eligibility

Improving your credit score is crucial for increasing your chances of loan approval and securing better loan terms. Here are some actionable tips to help you boost your credit score:

Monitor your credit reports regularly

It’s important to check your credit reports from all three major credit bureaus – Equifax, Experian, and TransUnion – at least once a year. This allows you to identify any errors or inaccuracies that could be dragging down your credit score. Dispute any discrepancies you find to ensure your credit report is correct.

Make timely payments on your debts

One of the most influential factors in determining your credit score is your payment history. Make sure to pay all your bills on time, including credit card payments, loan payments, and other debts. Setting up automatic payments or reminders can help you stay on track and avoid late payments.