Financial yield calculation is the key to unlocking the mysteries of investment decisions, offering a roadmap to financial success that is as trendy as a high school hip style. Get ready to dive into the realm of yields with a fresh perspective and an exciting approach that will leave you wanting more.

As we delve deeper into the realm of financial yield calculation, we will uncover the essential concepts and factors that shape this intriguing landscape.

Introduction to Financial Yield Calculation

Financial yield calculation refers to the process of determining the return on an investment over a specific period of time. It is a crucial aspect of financial analysis that helps investors assess the profitability and performance of their investments.

Understanding financial yield calculation is essential for making informed investment decisions as it provides insights into the potential returns that an investment can generate. By calculating the yield, investors can compare different investment opportunities and choose the ones that offer the best return on investment.

Basic Concept of Yield

Yield is a key metric in finance that measures the income generated by an investment relative to its cost. It is expressed as a percentage and can be calculated in various ways depending on the type of investment. The significance of yield lies in its ability to show investors how much they can expect to earn from their investment, taking into account factors such as interest, dividends, and capital gains.

- Yield helps investors assess the profitability of an investment and make comparisons between different investment options.

- It provides valuable information on the potential returns and risks associated with an investment, guiding investors in their decision-making process.

- By understanding yield, investors can make more informed choices that align with their financial goals and risk tolerance.

Types of Financial Yield Calculation

When it comes to calculating financial yield, there are several types that are commonly used in the world of finance. These include current yield, yield to maturity, and yield to call. Each type serves a unique purpose and is used in different scenarios to evaluate the return on investment.

Current Yield

The current yield is a simple calculation that measures the annual return on an investment based on its current market price. It is calculated by dividing the annual interest or dividend payment by the current market price of the investment. Current yield is most useful for evaluating fixed-income securities such as bonds, where the interest payments are fixed.

- Example: If a bond pays $50 in annual interest and its current market price is $1,000, the current yield would be 5% ($50/$1,000).

Yield to Maturity

Yield to maturity is a more complex calculation that takes into account the total return an investor can expect to receive if the investment is held until maturity. It considers not only the interest payments but also any capital gains or losses that may occur over the life of the investment. Yield to maturity is most useful for evaluating bonds with varying interest rates or for comparing different bond investments.

- Example: If an investor purchases a bond for $900 with a face value of $1,000 and holds it until maturity, the yield to maturity would factor in the difference between the purchase price and the face value, along with the interest payments received over time.

Yield to Call

Yield to call is similar to yield to maturity but focuses on the return an investor can expect if the investment is called by the issuer before maturity. This calculation takes into account the call price of the investment, any call premiums, and the remaining time until the call date. Yield to call is most useful for evaluating callable bonds or other securities that may be redeemed by the issuer before the maturity date.

- Example: If a callable bond is trading at $1,050 and has a call price of $1,000, the yield to call would factor in the call premium of $50 along with any remaining interest payments until the call date.

Factors Affecting Financial Yield Calculation

When calculating financial yields, several key factors come into play that can significantly impact the final results. Factors such as interest rates, time to maturity, bond prices, credit risk, and reinvestment assumptions play a crucial role in determining the overall yield on an investment.

Interest Rates

Interest rates have a direct impact on financial yield calculations. As interest rates fluctuate, the yield on an investment can vary. Higher interest rates typically result in higher yields, while lower interest rates lead to lower yields. It’s essential to consider the current interest rate environment when calculating the yield on an investment.

Time to Maturity

The time to maturity of a bond or investment also influences yield calculations. Generally, the longer the time to maturity, the higher the yield. This is because longer-term investments tend to carry higher risks, which are compensated for by a higher yield. Shorter-term investments typically offer lower yields due to their lower risk profile.

Bond Prices

Bond prices have an inverse relationship with yields. When bond prices increase, yields decrease, and vice versa. This is because the yield on a bond is calculated based on its current price and coupon payments. Understanding how bond prices fluctuate can help investors make informed decisions when calculating yields.

Credit Risk and Reinvestment Assumptions

Credit risk and reinvestment assumptions can also impact the accuracy of yield calculations. Higher credit risk investments generally offer higher yields to compensate for the increased risk of default. Additionally, the assumptions made about reinvesting coupon payments or dividends can affect the overall yield of an investment over time.

Methods for Financial Yield Calculation

Calculating financial yields is crucial for investors to assess the profitability of their investments. It involves using specific formulas to determine the return generated by different types of assets or securities.

Dividend Yield Calculation

Dividend yield is a common metric used to evaluate the return generated from investing in stocks. It is calculated by dividing the annual dividend per share by the current market price per share and multiplying by 100 to get a percentage.

Dividend Yield = (Annual Dividend per Share / Current Market Price per Share) x 100

Bond Yield Calculation

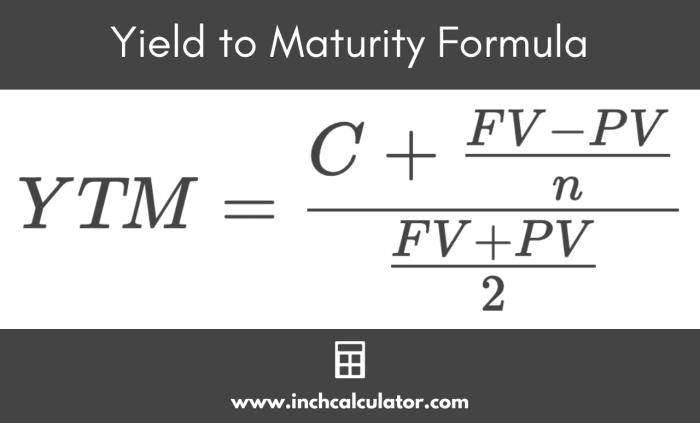

Calculating bond yield helps investors understand the return they can expect from investing in bonds. The yield to maturity formula considers the bond’s current price, par value, coupon rate, and time to maturity.

Yield to Maturity = [ (Annual Interest Payment + ((Par Value – Current Price) / Time to Maturity) ) / ((Par Value + Current Price) / 2) ] x 100

Importance of Accurate Data and Assumptions

It is essential to use precise and up-to-date data when performing yield calculations to ensure the accuracy of the results. Any incorrect information or assumptions can lead to misleading yield figures, affecting investment decisions.