financial portfolio balancing sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

In the world of finance, finding the perfect balance in your portfolio is like crafting the ultimate playlist for your future. It’s all about mixing different elements to create a harmonious blend that can withstand the test of time. Let’s dive into the art of financial portfolio balancing and discover the key strategies to rock your investments.

Importance of Financial Portfolio Balancing

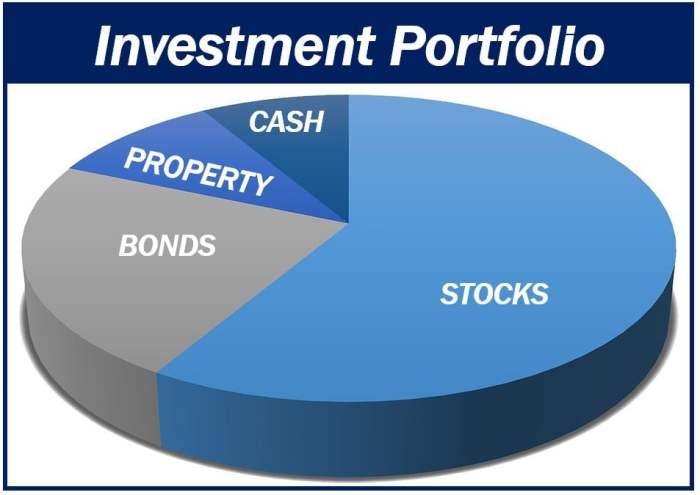

Balancing a financial portfolio is essential for long-term financial health as it helps mitigate risks, maximize returns, and ensure diversification. An unbalanced portfolio can lead to increased volatility, potential losses, and missed opportunities for growth. Market fluctuations can significantly impact the composition of a portfolio, making regular rebalancing crucial to maintain the desired asset allocation and risk level.

Impact of Unbalanced Portfolios

An unbalanced portfolio may have an overweighted exposure to a specific asset class, such as stocks, leading to higher risk during market downturns. Conversely, an underweighted allocation might result in missed opportunities for growth in high-performing sectors. Rebalancing helps investors realign their portfolios to meet their financial goals and risk tolerance.

Market Fluctuations and Rebalancing

Market fluctuations can cause shifts in the value of assets within a portfolio, disrupting the intended asset allocation. Rebalancing involves selling overperforming assets and buying underperforming ones to bring the portfolio back in line with the target allocation. This process ensures that investors maintain a disciplined approach to investing and avoid emotional decision-making based on short-term market movements.

Strategies for Financial Portfolio Balancing

When it comes to balancing a financial portfolio, there are several traditional methods that investors use to ensure their investments are diversified and optimized for returns.

Traditional Methods for Portfolio Balancing

- Asset Allocation: Investors allocate their investments across different asset classes such as stocks, bonds, and cash equivalents based on their risk tolerance and investment goals.

- Rebalancing: Periodically adjusting the portfolio by buying or selling assets to maintain the desired asset allocation mix.

- Risk Management: Implementing strategies to minimize potential losses and protect the portfolio from market volatility.

Passive vs. Active Portfolio Balancing Strategies

Passive portfolio balancing involves maintaining a long-term investment strategy without frequent buying or selling of assets. This approach aims to match the performance of a specific market index. On the other hand, active portfolio balancing involves more frequent trading and attempts to outperform the market through strategic asset selection and timing.

Role of Diversification in Portfolio Balancing

Diversification is a key strategy in maintaining a balanced portfolio. By spreading investments across different asset classes, industries, and geographical regions, investors can reduce risk and minimize the impact of market fluctuations on their overall portfolio performance.

Tools and Technologies for Portfolio Balancing

When it comes to managing and optimizing your financial portfolio, there are various tools and technologies available to assist you in monitoring and rebalancing your investments.

Software and Platforms

There are several software programs and online platforms that can help you keep track of your investment portfolio and ensure it remains balanced. Some popular tools include:

- Personal Capital: This platform offers a comprehensive view of your financial accounts and investments, helping you analyze and rebalance your portfolio as needed.

- Wealthfront: Known for its automated investment services, Wealthfront uses algorithms to provide personalized investment recommendations and rebalance portfolios accordingly.

- Betterment: Another robo-advisor, Betterment offers automated portfolio management and tax-efficient strategies to optimize your investments.

Robo-Advisors

Robo-advisors have revolutionized the way individuals approach portfolio balancing by offering automated, algorithm-driven investment strategies. These platforms use technology to manage your investments based on your financial goals and risk tolerance, taking the guesswork out of rebalancing.

Robo-advisors provide a hands-off approach to portfolio management, making it easier for investors to maintain a diversified and balanced portfolio.

Algorithms and AI

Artificial Intelligence (AI) and sophisticated algorithms play a crucial role in optimizing portfolio balance. By analyzing vast amounts of data and market trends, AI can identify investment opportunities, minimize risks, and rebalance portfolios more efficiently than traditional methods.

Challenges in Financial Portfolio Balancing

Balancing a financial portfolio can be a complex task due to various challenges that investors may face. These challenges can range from emotional biases to tax implications that impact decision-making processes.

Emotional Biases in Portfolio Balancing

Emotional biases such as fear, greed, and overconfidence can hinder effective portfolio balancing. Investors may be reluctant to sell losing investments due to fear of missing out on potential gains or may hold onto winning investments for too long out of greed. Overcoming these biases requires discipline, rational decision-making, and a long-term investment strategy.

Impact of Taxation on Portfolio Rebalancing

Tax implications play a significant role in portfolio rebalancing decisions. Investors need to consider capital gains taxes, dividend taxes, and other tax consequences when adjusting their portfolios. Tax-efficient strategies such as tax-loss harvesting and asset location can help minimize the impact of taxation on portfolio returns.