Financial literacy for kids sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

As we dive into the world of financial literacy for kids, we uncover the essential aspects that shape their understanding of money management and pave the way for a financially savvy future.

Importance of Financial Literacy for Kids

Teaching financial literacy to kids is crucial as it equips them with essential skills to make informed financial decisions in the future. By educating children about money management early on, we can help them develop responsible financial habits that will benefit them throughout their lives.

Financial Independence

Financial literacy empowers children to understand the value of money and the importance of saving and budgeting. By learning these skills at a young age, kids can become more financially independent as adults, avoiding common pitfalls like overspending or accumulating debt.

- Teaching kids about the concept of earning money through chores or a part-time job can instill a strong work ethic and help them appreciate the value of hard work.

- Setting up a savings account for children and encouraging them to save a portion of their allowance can teach them the importance of saving for future goals or emergencies.

Future Financial Stability

Early financial education can have a significant impact on children’s future financial decisions. Kids who are financially literate are more likely to make informed choices about investments, loans, and other financial matters, leading to greater financial stability and security as adults.

By teaching kids about the power of compound interest and the risks of debt, we can help them make smart financial decisions that can lead to long-term wealth accumulation.

- Introducing children to basic concepts like budgeting and investing can lay the foundation for sound financial decision-making later in life.

- Teaching kids about the importance of credit scores and how they can affect future borrowing opportunities can help them avoid costly mistakes in the future.

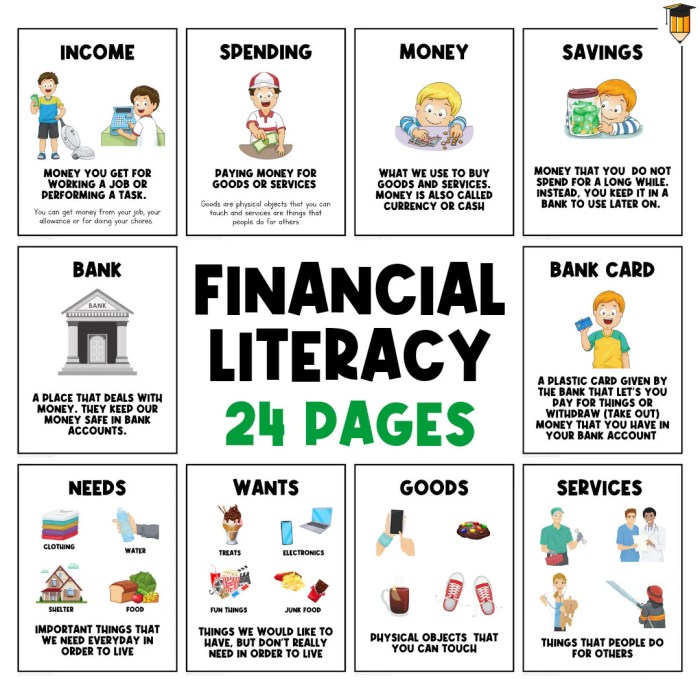

Basic Concepts to Teach Kids

Teaching kids about financial concepts at a young age can set them up for a lifetime of success. It’s important to introduce these concepts in a way that is easy for them to understand and apply in their daily lives.

Saving Money

- Explain to kids the importance of saving money for future needs or emergencies.

- Set up a piggy bank or savings account for them to deposit their allowance or gift money.

- Encourage them to set savings goals, such as saving for a toy or a special outing.

- Teach them the concept of delayed gratification by saving up for something they really want.

Budgeting

- Show kids how to create a simple budget by tracking their income (allowance, gifts) and expenses (toys, treats).

- Explain the importance of prioritizing needs over wants when budgeting.

- Involve them in decision-making when it comes to spending money, emphasizing the concept of trade-offs.

- Teach them to allocate a portion of their income for saving and giving back to the community.

Investing

- Introduce the concept of investing as a way to make money grow over time.

- Explain simple investment options like buying stocks in companies they know or investing in a college savings account.

- Teach them about the power of compound interest and how it can help their money grow faster.

- Encourage them to start small and gradually increase their investment knowledge as they grow older.

Practical Activities for Teaching Financial Literacy

Teaching kids about money management through practical activities can make learning fun and engaging. By incorporating interactive exercises, role-playing scenarios, and games, children can develop essential financial skills from an early age.

Budgeting Games

Playing budgeting games can help children understand the concept of managing money within a set limit. One popular game is “Grocery Store Budget Challenge,” where kids are given a budget and must plan a shopping list within that limit. This activity teaches them the value of making choices based on available funds.

Entrepreneurial Role-Playing

Engaging kids in entrepreneurial role-playing scenarios can help them grasp the concepts of earning and spending money. Set up a pretend lemonade stand or a small business where children can experience firsthand the process of making sales, calculating profits, and deciding how to reinvest or save their earnings.

Savings Jar Activity

Create a savings jar for kids to decorate and use as a visual aid for setting financial goals. Encourage them to save a portion of their allowance or earnings in the jar regularly. This activity reinforces the importance of saving for future needs or wants and helps children understand the concept of delayed gratification.

Financial Literacy Board Games

Introduce board games like “The Allowance Game” or “Money Bags” that are designed to teach kids about financial concepts such as budgeting, saving, and investing. These games make learning about finances enjoyable and interactive, allowing children to practice essential money management skills in a fun setting.

Online Simulations

Utilize online financial simulations or apps that are tailored for kids to learn about money management in a virtual environment. Platforms like “Money Metropolis” or “Bankaroo” simulate real-life financial scenarios, allowing children to make decisions on earning, spending, and saving money while receiving immediate feedback on their choices.

Family Financial Discussions

Incorporate regular family discussions about finances to involve children in real-world money decisions. Encourage them to participate in setting financial goals, budgeting for family activities, or researching money-saving tips. This hands-on approach helps children understand the practical applications of financial literacy in everyday life.

Resources and Tools for Parents and Educators

Financial literacy for kids is crucial, and having access to the right resources and tools can make a significant difference in their learning journey. Here are some useful resources for parents and educators to teach financial literacy to kids effectively.

Books

- “Money Ninja: A Children’s Book About Saving, Investing, and Donating” by Janet Ong Zimmerman – This book uses relatable stories and engaging illustrations to introduce kids to key financial concepts.

- “The Everything Kids’ Money Book” by Brette McWhorter Sember – This comprehensive guide covers topics like budgeting, earning money, and understanding the value of saving.

Websites

- MoneyAsYouGrow.org – Provides age-appropriate activities and resources to help kids develop money management skills.

- PracticalMoneySkills.com – Offers a wide range of financial literacy resources for educators, including lesson plans and interactive tools.

Apps

- Bankaroo – A virtual bank for kids that helps them track their allowance, set savings goals, and learn about budgeting.

- PiggyBot – An app that teaches kids about money management through virtual piggy banks and goal-setting features.

Role of Schools

Schools play a crucial role in promoting financial literacy among students. Collaboration between parents, educators, and schools can enhance the learning experience. Some strategies for collaboration include integrating financial literacy into the curriculum, organizing workshops or events, and providing resources for both students and teachers.