Diving deep into the world of auto loan refinancing options, this introduction sets the stage for an informative and engaging exploration that will leave readers craving more. Get ready to discover the ins and outs of how to make the most of your auto loan through refinancing.

In the following paragraphs, we will delve into the different types of refinancing available, eligibility criteria, the refinancing process, and much more. So buckle up and let’s navigate the world of auto loan refinancing together.

Understanding Auto Loan Refinancing Options

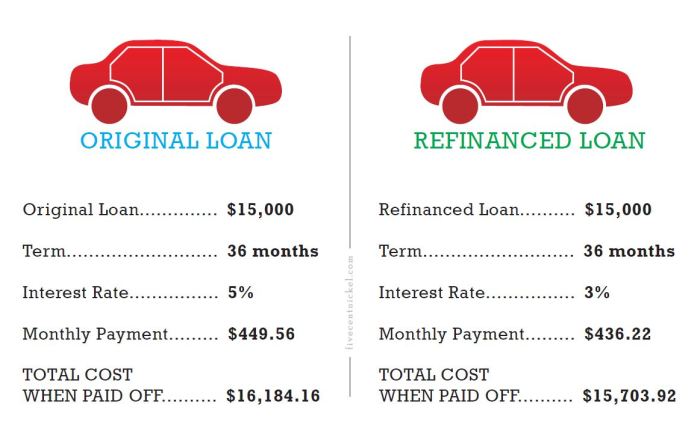

When it comes to auto loan refinancing, it’s all about swapping your current car loan for a new one with better terms. This could mean lower monthly payments, reduced interest rates, or a shorter loan term. But before jumping into refinancing, it’s important to understand how it works and what factors to consider.

Benefits of Auto Loan Refinancing

- Lower Interest Rates: By refinancing, you may qualify for a lower interest rate, which can save you money over the life of the loan.

- Reduced Monthly Payments: Refinancing can also lead to lower monthly payments, giving you more breathing room in your budget.

- Shorter Loan Term: If you’re looking to pay off your car sooner, refinancing into a shorter loan term can help you achieve that goal.

Factors to Consider Before Refinancing

Before refinancing your auto loan, consider the following factors:

- Your Credit Score: A higher credit score can help you qualify for better refinancing terms.

- Current Interest Rates: Make sure to compare current interest rates with what you’re currently paying to see if refinancing makes sense.

- Loan Term: Decide whether you want to extend or shorten your loan term based on your financial goals.

- Fees and Penalties: Be aware of any fees or penalties associated with refinancing to ensure it’s a cost-effective option.

Types of Auto Loan Refinancing Options

When it comes to auto loan refinancing, there are a few different options available in the market. Understanding the types of refinancing options can help you make an informed decision that suits your financial needs.

Fixed-Rate Refinancing

Fixed-rate refinancing involves locking in an interest rate that remains the same throughout the life of the loan. This option provides stability and predictability in your monthly payments, making it easier to budget. However, if interest rates decrease, you may end up paying more than the current market rate.

Variable-Rate Refinancing

On the other hand, variable-rate refinancing offers an interest rate that fluctuates based on market conditions. While initially lower than fixed rates, variable rates can increase over time, resulting in higher monthly payments. This option is ideal if you expect interest rates to decrease in the future.

Lenders Offering Auto Loan Refinancing Services

There are several lenders in the market that offer auto loan refinancing services to borrowers. Some of the popular lenders include:

1. LightStream

2. Capital One

3. Bank of America

4. LendingClub

5. PenFed Credit Union

Each lender may have different eligibility criteria, interest rates, and terms, so it’s essential to compare offers from multiple lenders before making a decision. Consider factors like interest rates, fees, repayment terms, and customer service when choosing a lender for auto loan refinancing.

Eligibility Criteria and Requirements

To qualify for auto loan refinancing, borrowers must meet certain criteria and provide specific documentation. Understanding these requirements is crucial for those looking to improve their loan terms.

Common Eligibility Criteria

- Proof of income: Lenders typically require borrowers to have a stable source of income to ensure they can make timely payments.

- Credit score: A good credit score is essential for securing better refinancing options. Most lenders look for a score of 660 or higher.

- Loan-to-value ratio: Lenders may require a certain loan-to-value ratio to qualify for refinancing, typically around 90% or lower.

- Vehicle age and mileage: Some lenders have restrictions on the age and mileage of the vehicle being refinanced.

Documentation and Credit Score Requirements

- Proof of income: Pay stubs, tax returns, or bank statements may be required to verify income.

- Vehicle information: Registration, insurance documents, and details about the vehicle being refinanced.

- Credit report: Lenders will pull your credit report to assess your creditworthiness and determine the interest rate.

Borrowers with a credit score below 660 may still qualify for refinancing, but they may face higher interest rates.

Improving Qualification Chances

- Improve credit score: Paying bills on time, reducing debt, and correcting any errors on your credit report can help boost your credit score.

- Reduce debt-to-income ratio: Lowering your debt-to-income ratio by paying off existing debts can make you a more attractive borrower.

- Shop around: Compare offers from multiple lenders to find the best refinancing option that suits your financial situation.

Process of Auto Loan Refinancing

When considering auto loan refinancing, it’s important to understand the step-by-step process involved to make informed decisions about your financial situation.

To begin the process of refinancing your auto loan, follow these general steps:

1. Evaluate Your Current Auto Loan Terms

- Check your current loan balance, interest rate, and monthly payment.

- Review your credit score to see if it has improved since taking out the original loan.

- Understand any fees or penalties for early repayment that may apply.

2. Research and Compare Lenders

- Shop around and compare offers from different lenders to find the best refinancing option.

- Consider factors such as interest rates, loan terms, and customer reviews.

- Choose a lender that offers the most competitive rates and terms for your financial situation.

3. Apply for Auto Loan Refinancing

- Submit an application with the chosen lender, providing all required documentation and information.

- Wait for the lender to review your application and make a decision on your refinancing request.

- Once approved, review the new loan terms and conditions carefully before signing the agreement.

Calculating Potential Savings

Use an online auto loan refinancing calculator to estimate your potential savings based on the new loan terms and interest rate.

Tips for a Successful Refinancing Experience

- Improve your credit score before applying to qualify for lower interest rates.

- Negotiate with lenders to secure the best possible terms for your refinanced auto loan.

- Be aware of any additional fees or charges associated with the refinancing process.

- Stay organized and keep track of all paperwork and communication with lenders throughout the process.