The loan application process explained sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. From understanding the stages involved to exploring the different types of loans available, this guide is your go-to resource for navigating the complex world of loan applications.

Get ready to dive into the intricacies of loan applications and emerge with a newfound confidence in your financial journey.

Overview of Loan Application Process

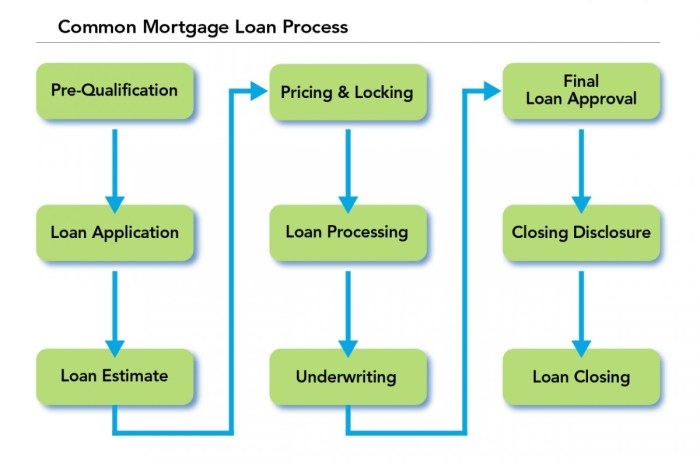

When applying for a loan, there are several stages involved in the process, from gathering necessary documents to final approval. It’s essential to understand these steps to navigate the process successfully.

Stages of the Loan Application Process

- Research and Pre-Qualification: Before applying for a loan, it’s crucial to research different lenders, loan types, and pre-qualify to understand your borrowing capacity.

- Application Submission: Once you’ve chosen a lender, you’ll need to fill out an application form with your personal and financial information.

- Document Submission: Key documents required for a loan application include proof of income, identification, bank statements, and tax returns.

- Verification and Underwriting: The lender will verify the information provided, assess your creditworthiness, and determine the terms of the loan.

- Approval and Funding: If your application is approved, you’ll receive a loan offer detailing the terms and conditions. Upon acceptance, the funds will be disbursed.

- Repayment: After receiving the loan, you’re responsible for making regular payments according to the agreed-upon schedule.

Key Documents for a Loan Application

- Proof of Income: Pay stubs, tax returns, or bank statements to demonstrate your ability to repay the loan.

- Identification: A government-issued ID to verify your identity.

- Bank Statements: Showing your financial history and current assets.

- Tax Returns: Providing insight into your financial situation and income.

Impact of Credit Scores on Loan Application

Your credit score plays a significant role in the loan application process, influencing the interest rate, loan amount, and approval decision.

- A higher credit score indicates lower risk for the lender, leading to better loan terms.

- Lower credit scores may result in higher interest rates or loan rejections.

- It’s essential to maintain a good credit score by paying bills on time and managing debts responsibly.

Importance of Pre-Qualification

- Pre-qualification helps you understand how much you can borrow and the loan terms you’re eligible for.

- It allows you to compare offers from different lenders and choose the best option for your financial situation.

- Pre-qualification can speed up the application process and increase your chances of approval.

Types of Loans

When applying for a loan, there are different types to consider depending on your needs and financial situation.

Personal Loans

Personal loans are unsecured loans that can be used for various purposes such as debt consolidation, home improvements, or unexpected expenses. These loans typically have higher interest rates compared to secured loans like mortgages or auto loans.

Mortgage Loans

Mortgage loans are secured loans used to purchase a home. The property serves as collateral for the loan, which means the lender can foreclose on the property if the borrower fails to make payments. Mortgage loans usually have lower interest rates compared to unsecured loans.

Auto Loans

Auto loans are also secured loans where the vehicle acts as collateral. These loans are used to finance the purchase of a car, truck, or other vehicle. Auto loans typically have fixed interest rates and repayment terms.

Comparison of Secured and Unsecured Loans

Secured loans require collateral, such as a home or vehicle, which reduces the risk for the lender. Unsecured loans, like personal loans, do not require collateral but often have higher interest rates to compensate for the increased risk.

Specific Requirements for Each Type of Loan

– Personal loans may require proof of income, credit history, and employment verification.

– Mortgage loans typically require a down payment, credit score, and proof of income for mortgage approval.

– Auto loans may require a down payment, proof of insurance, and vehicle information for loan approval.

Suitability of Each Type of Loan

– Personal loans are suitable for debt consolidation, home renovations, or unexpected expenses.

– Mortgage loans are best for purchasing a home or refinancing an existing mortgage.

– Auto loans are ideal for financing the purchase of a vehicle or refinancing an existing auto loan.

Application Submission

When it comes to submitting a loan application, there are several methods available to choose from. Whether you prefer the convenience of applying online, the personal touch of submitting in-person, or the traditional route of sending it by mail, it’s important to consider which option works best for you.

Methods of Submission

- Online: Many lenders offer the option to apply for a loan through their website, allowing you to fill out the application form electronically and submit it with just a few clicks.

- In-person: Some borrowers prefer to visit a physical branch or office to speak with a loan officer directly and submit their application face-to-face.

- By mail: For those who prefer a more traditional approach, mailing in a paper application is still an option. Just make sure to allow extra time for processing.

Importance of Accuracy and Completeness

It’s crucial to ensure that your loan application is filled out accurately and completely. Any errors or missing information could delay the approval process or even lead to a rejection. Double-check all details before submitting to avoid any potential setbacks.

Truthful Disclosure of Information

Be honest and transparent when providing information on your loan application. Lenders rely on the details you provide to make their decision, so it’s essential to disclose all relevant information truthfully. Failing to do so could result in serious consequences down the line.

Tips for a Strong Application

- Organize your financial documents: Have all necessary documents ready, such as pay stubs, bank statements, and tax returns, to support your application.

- Check your credit report: Review your credit report for any errors or discrepancies that could affect your loan approval. Dispute any inaccuracies before applying.

- Provide a detailed explanation: If there are any negative factors on your credit report or financial history, be prepared to provide a clear explanation to the lender.

- Seek pre-approval: Getting pre-approved for a loan can give you a better idea of how much you can borrow and show sellers that you’re a serious buyer.

Application Review and Approval

After submitting your loan application, the next step is the review and approval process. This is where the lender evaluates your financial information and credit history to determine if you qualify for the loan.

Typical Timeline for Loan Application Review

- Loan application review timelines can vary depending on the lender and the type of loan you are applying for.

- Typically, it takes anywhere from a few days to a few weeks for the lender to review your application and make a decision.

- Some lenders offer expedited review processes for urgent situations, but this may come with additional fees.

Evaluating Credit History and Financial Information

- Lenders will look at your credit score, income, debt-to-income ratio, employment history, and other financial information to assess your creditworthiness.

- A higher credit score and a stable income are usually favorable factors for loan approval.

- Having a low debt-to-income ratio and a good payment history can also increase your chances of approval.

Common Reasons for Application Rejection

- Low credit score or poor credit history

- Insufficient income to cover loan payments

- High debt-to-income ratio

- Unstable employment history

Negotiating Terms and Conditions

- If your loan application is approved, you may have the opportunity to negotiate the terms and conditions of the loan.

- You can discuss the interest rate, repayment schedule, and any other fees associated with the loan.

- It’s important to carefully review the terms and conditions before accepting the loan offer and to make sure you fully understand your obligations as a borrower.