Diving into the world of Investment research tools, this introduction sets the stage for a deep exploration of how these tools shape the financial landscape. With a fresh and engaging twist, readers are invited to discover the key to informed investment decisions.

Exploring the various types, benefits, and impact of investment research tools, this overview sheds light on the essential role they play in empowering investors to navigate the complex world of finance with confidence.

Overview of Investment Research Tools

Investment research tools are essential instruments in the financial industry that provide investors with valuable information and analysis to make informed decisions regarding their investments. These tools help individuals and professionals alike to gather data, conduct research, and analyze trends in the market to maximize returns and minimize risks.

Popular Investment Research Tools

- Yahoo Finance: A widely used platform that offers a range of tools, including stock screening, portfolio tracking, and real-time market data.

- Morningstar: Known for its comprehensive research reports, ratings, and analysis on various investment options, such as mutual funds, stocks, and ETFs.

- Bloomberg Terminal: A professional-grade tool that provides real-time financial data, news, and analytics for investors, traders, and financial professionals.

- Seeking Alpha: An online platform where investors can access articles, analysis, and investment recommendations from a community of contributors.

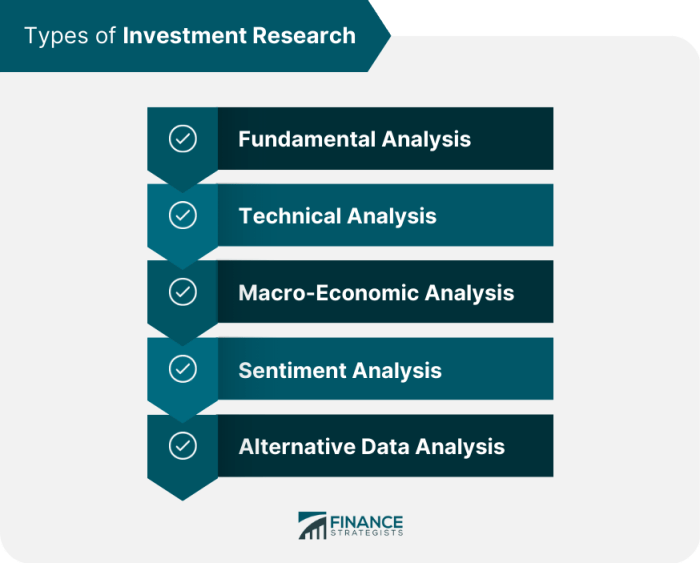

Types of Investment Research Tools

Investment research tools can be classified into two main categories: fundamental analysis tools and technical analysis tools. Each type plays a crucial role in helping investors make informed decisions in the financial markets.

Fundamental Analysis Tools

Fundamental analysis tools focus on evaluating the intrinsic value of a security by analyzing various economic, financial, and qualitative factors. These tools help investors understand the health and performance of a company to determine if its stock is undervalued or overvalued.

- Financial Statements Analysis: This tool involves examining a company’s balance sheet, income statement, and cash flow statement to assess its financial health and performance.

- Ratio Analysis: Investors use ratios such as price-to-earnings (P/E), price-to-book (P/B), and debt-to-equity to evaluate a company’s profitability, valuation, and financial leverage.

- Company News and Events: Monitoring news, earnings reports, and industry developments can provide valuable insights into a company’s growth prospects and potential risks.

Technical Analysis Tools

Technical analysis tools focus on studying past market data, primarily price and volume, to forecast future price movements. These tools help investors identify trends, patterns, and potential entry/exit points for trading decisions.

- Charts and Patterns: Tools like candlestick charts, line charts, and chart patterns (such as head and shoulders, double tops/bottoms) help investors visualize price trends and patterns.

- Indicators and Oscillators: Technical indicators like moving averages, Relative Strength Index (RSI), and MACD help investors identify overbought or oversold conditions in the market.

- Volume Analysis: Analyzing trading volume can confirm price trends and signal potential reversals in the market, providing additional insights for decision-making.

Benefits of Using Investment Research Tools

Investment research tools offer numerous advantages to investors, helping them make informed decisions and maximize their returns.

Time-saving Efficiency

- By providing access to real-time data and analysis, investment research tools can save investors valuable time in conducting research and monitoring market trends.

- Automation features streamline the process of gathering information, allowing investors to focus on decision-making rather than data collection.

Identification of Investment Opportunities

- These tools assist investors in identifying potential investment opportunities by offering insights into market trends, company performance, and sector analysis.

- Advanced algorithms can scan vast amounts of data to pinpoint undervalued stocks or emerging market trends that may go unnoticed otherwise.

Risk Management and Portfolio Diversification

- Investment research tools help in mitigating risks by providing risk assessment metrics, volatility analysis, and correlation studies to guide investors in making diversified investment decisions.

- Portfolio optimization tools help in balancing risk and return by suggesting the most suitable asset allocation based on individual investor goals and risk tolerance.

Key Features to Look for in Investment Research Tools

When choosing an investment research tool, it’s crucial to consider key features that will help you make informed decisions and stay ahead in the market. Look for tools that offer real-time data, customizable alerts, and advanced charting capabilities to enhance your investment strategies.

Real-Time Data

One of the essential features to look for in an investment research tool is real-time data. This ensures that you have access to up-to-date information on market trends, stock prices, and other relevant data that can impact your investment decisions. Real-time data allows you to make informed decisions quickly and react to market changes promptly.

Customizable Alerts

Another key feature to consider is customizable alerts. These alerts can be tailored to your specific preferences and investment goals, notifying you of important events or changes in the market that may affect your portfolio. Customizable alerts help you stay informed and take action when needed, without constantly monitoring the market.

Charting Capabilities

Charting capabilities are also crucial when evaluating investment research tools. Advanced charting features allow you to visualize data trends, patterns, and correlations, helping you identify potential investment opportunities and risks. Look for tools that offer customizable charts and technical analysis tools to enhance your decision-making process.

User Interface and Ease of Use

In addition to these key features, it’s important to compare different tools based on their user interfaces and ease of use. A user-friendly interface with intuitive navigation can make a significant difference in your overall experience with the tool. Consider your individual needs and preferences when selecting an investment research tool to ensure it meets your requirements and enhances your investment journey.

How Investment Research Tools Impact Investment Strategies

Investment research tools play a crucial role in shaping the investment strategies of individuals and organizations alike. These tools provide valuable insights, data, and analysis that can significantly impact decision-making processes and ultimately lead to more informed investment decisions.

Influencing Decision-Making Process

Investment research tools influence the decision-making process of investors by providing them with key information and analysis to assess potential opportunities and risks. By using these tools, investors can conduct thorough research, analyze market trends, and evaluate the performance of various assets or securities. This helps investors make more informed decisions based on data-driven insights rather than relying solely on intuition or speculation.

- Research tools help investors identify undervalued assets or sectors that have the potential for growth.

- They enable investors to assess the financial health and stability of companies by analyzing key financial ratios and performance indicators.

- Research tools provide access to historical data and performance metrics, allowing investors to track and monitor the progress of their investments over time.

Developing and Refining Investment Strategies

Investment research tools can be used to develop and refine investment strategies by helping investors identify market trends, assess risks, and optimize portfolio allocation. By utilizing these tools, investors can create well-informed strategies that are tailored to their financial goals and risk tolerance.

For example, a long-term investor may use research tools to identify blue-chip stocks with a history of consistent dividends and strong financial performance to build a stable income-generating portfolio.

- Research tools can assist in diversifying investment portfolios to minimize risk and maximize returns.

- They help investors stay informed about market developments and adjust their strategies accordingly to capitalize on emerging opportunities.

- By leveraging research tools, investors can fine-tune their strategies based on changing market conditions and economic trends.

Examples of Successful Investment Strategies

Several successful investment strategies have been implemented with the help of research tools, demonstrating the impact of data-driven decision-making on investment outcomes. For instance, quantitative analysis tools have been used to develop algorithmic trading strategies that capitalize on market inefficiencies and trends.

- Hedge funds utilize advanced research tools to identify arbitrage opportunities and generate alpha for their investors.

- Risk management tools help investors mitigate potential losses and protect their portfolios during market downturns.

- Social sentiment analysis tools enable investors to gauge market sentiment and make informed decisions based on collective investor behavior.