With mortgage payment calculator at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights.

When it comes to managing your finances and planning for the future, understanding how a mortgage payment calculator works can be a game-changer. This tool provides valuable insights into your potential monthly payments and helps you make informed decisions about your home loan. Let’s dive into the world of mortgage payment calculators and explore how they can benefit you.

Introduction to Mortgage Payment Calculator

Yo, check it – a mortgage payment calculator is a handy tool that helps you figure out how much you gotta pay every month for your crib. It takes into account factors like your loan amount, interest rate, and loan term to give you an estimate of your monthly mortgage payment. This way, you can plan your budget like a boss and make sure you can handle those payments without breaking a sweat.

Popular Mortgage Payment Calculators

Here are some dope mortgage payment calculators you can find online:

- Zillow: This calculator is lit and super easy to use. Just plug in your deets and get an instant estimate of your monthly mortgage payment.

- Bankrate: Another solid option, Bankrate’s mortgage calculator helps you crunch the numbers and see how different factors affect your monthly payments.

- NerdWallet: Don’t sleep on NerdWallet’s mortgage calculator – it’s user-friendly and gives you a detailed breakdown of your monthly costs.

How Mortgage Payment Calculators Work

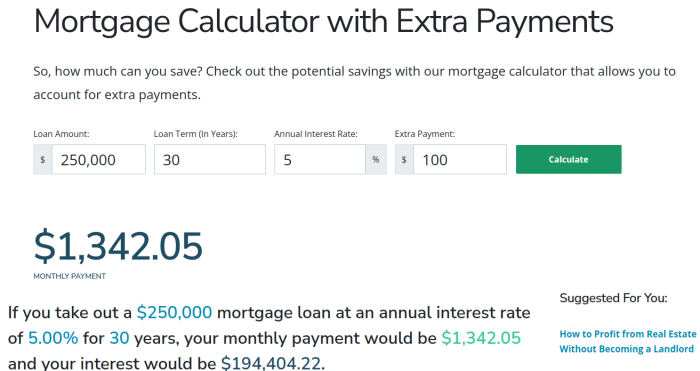

Mortgage payment calculators are handy tools that help individuals estimate their monthly mortgage payments based on various factors. These calculators require specific inputs to provide accurate results and are based on a standard formula used in the mortgage industry.

To calculate monthly mortgage payments, users need to input information such as the loan amount, interest rate, loan term (in years), and sometimes additional costs like property taxes and insurance. These inputs help the calculator determine the total amount to be paid each month towards the mortgage.

Formula Used for Calculating Monthly Payments

The formula commonly used by mortgage payment calculators to calculate monthly payments is:

Monthly Payment = P [ r(1 + r)^n ] / [ (1 + r)^n – 1]

Where:

– P = Principal loan amount

– r = Monthly interest rate (annual interest rate divided by 12)

– n = Total number of payments (loan term in years multiplied by 12)

This formula takes into account the principal loan amount, interest rate, and loan term to determine the monthly payment amount accurately.

Comparison of Different Mortgage Payment Calculators

There are various mortgage payment calculators available online, each with its methodology for computing mortgage payments. Some calculators may consider additional factors like property taxes and insurance, while others focus solely on the principal amount, interest rate, and loan term.

It’s essential to compare different calculators to ensure you are getting accurate estimates of your monthly mortgage payments. Look for calculators that provide detailed breakdowns of the payment, including principal and interest amounts, and consider using multiple calculators for a more comprehensive understanding of your financial obligations.

Benefits of Using a Mortgage Payment Calculator

Using a mortgage payment calculator can provide numerous advantages for individuals looking to manage their finances effectively and plan for the future. By utilizing this tool, borrowers can make informed decisions that align with their financial goals and capabilities.

Accurate Budgeting and Planning

- One of the key benefits of using a mortgage payment calculator is the ability to accurately budget and plan for monthly expenses.

- By entering details such as loan amount, interest rate, and term, borrowers can determine the exact amount they need to set aside each month for their mortgage payments.

- This helps individuals ensure that they are not overspending and allows them to allocate funds for other essential expenses.

Exploring Different Scenarios

- With a mortgage payment calculator, borrowers can explore various scenarios to find the most suitable option for their financial situation.

- They can adjust factors like down payment amount, loan term, and interest rate to see how different variables impact their monthly payments.

- This flexibility allows borrowers to make informed decisions based on their preferences and financial capabilities.

Empowering Informed Decision-Making

- By using a mortgage payment calculator, borrowers gain a better understanding of their financial obligations and the overall cost of homeownership.

- They can compare different loan options, evaluate affordability, and choose a mortgage that aligns with their long-term financial goals.

- This tool empowers individuals to make informed decisions that can positively impact their financial well-being in the long run.

Understanding the Results

When using a mortgage payment calculator, the results generated can provide valuable insights into the financial aspects of taking out a mortgage. Understanding these results is crucial for making informed decisions about your mortgage options.

Interpreting Monthly Payment and Total Interest Paid

- The monthly payment amount calculated by the mortgage payment calculator represents the total amount you will need to pay each month towards your mortgage, including principal and interest.

- Total interest paid is the cumulative amount of interest you will end up paying over the life of the loan in addition to the principal amount borrowed.

Effects of Changes in Inputs on Mortgage Payments

- Increasing the loan amount or interest rate will result in higher monthly payments and a greater total interest paid.

- Extending the loan term will lower monthly payments but increase the total interest paid over time.

Utilizing Results to Guide Mortgage Options

- Understanding the results can help borrowers assess their financial capabilities and choose a mortgage plan that aligns with their budget and long-term goals.

- Comparing different scenarios using the calculator can assist in selecting the most suitable mortgage option based on individual preferences and financial circumstances.