As forex trading strategies take center stage, this opening passage invites readers into a world of financial prowess and strategic decision-making. Get ready to dive into the dynamic realm of forex trading strategies with a blend of expertise and innovation.

In the following paragraphs, we will delve into the various types of strategies, fundamental and technical analysis tools, risk management strategies, and the essentials of developing a solid forex trading plan.

Types of Forex Trading Strategies

When it comes to trading in the forex market, there are various strategies that traders can utilize to make profits. These strategies can be broadly categorized into two main types: long-term strategies and short-term strategies.

Long-Term Strategies

Long-term strategies in forex trading involve holding positions for an extended period, often weeks, months, or even years. These strategies are based on fundamental analysis and macroeconomic factors that affect currency movements over a longer period. One common long-term strategy is trend trading, where traders aim to profit from the long-term trends in the forex market by identifying and following the direction of the trend. Another example is carry trading, where traders earn profits from the interest rate differentials between two currencies.

Short-Term Strategies

Short-term strategies, on the other hand, involve holding positions for a shorter period, ranging from minutes to days. These strategies are based on technical analysis and short-term price movements in the market. Scalping is a popular short-term strategy where traders aim to make quick profits by entering and exiting trades rapidly, often within minutes. Another example is day trading, where traders open and close positions within the same trading day to capitalize on intraday price movements.

Comparison of Effectiveness

Both long-term and short-term strategies have their own advantages and disadvantages. Long-term strategies are less stressful and require less time monitoring the market compared to short-term strategies. However, short-term strategies can offer more frequent trading opportunities and potentially higher returns in a shorter period. The effectiveness of each strategy ultimately depends on the trader’s risk tolerance, trading style, and market conditions.

Fundamental Analysis in Forex Trading

Fundamental analysis in forex trading involves evaluating the underlying factors that can affect the value of a currency. This type of analysis focuses on economic indicators, monetary policy decisions, and geopolitical events to make informed trading decisions.

Economic Indicators Impacting Currency Values

Economic indicators such as Gross Domestic Product (GDP), inflation rates, interest rates, and employment data can significantly impact currency values. For example, a country with a strong GDP growth rate is likely to have a stronger currency compared to a country with a stagnant economy. Traders use these indicators to assess the health of an economy and predict future currency movements.

Geopolitical Events and Forex Markets

Geopolitical events like elections, wars, trade agreements, and natural disasters can have a major impact on forex markets. For instance, political instability in a country can lead to a decline in its currency value as investors become wary of the risks involved. Traders closely monitor geopolitical events to anticipate market reactions and adjust their trading strategies accordingly.

Technical Analysis Tools

Technical analysis tools are essential for forex traders to make informed decisions based on historical price movements and trends. These tools help traders identify potential entry and exit points, as well as gauge market sentiment.

Commonly Used Technical Analysis Tools

There are several technical analysis tools commonly used in forex trading:

- Moving Averages

- Fibonacci Retracements

- Relative Strength Index (RSI)

- Bollinger Bands

- Support and Resistance Levels

How Moving Averages and Fibonacci Retracements are Used

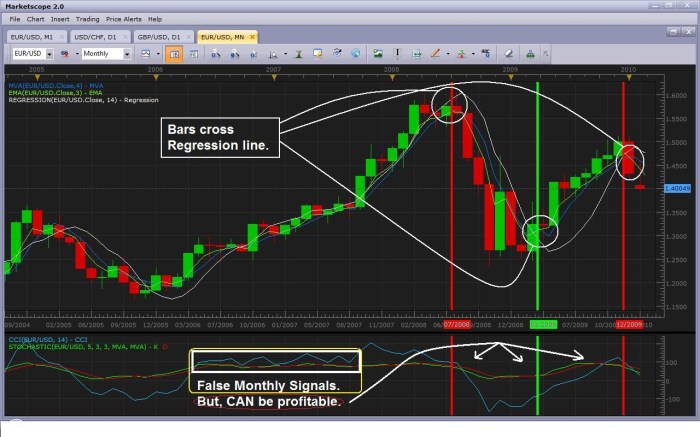

Moving averages are used to smooth out price data and identify trends over a specified period. Traders often use the crossover of different moving averages to signal potential buy or sell opportunities.

On the other hand, Fibonacci retracements are used to identify potential support and resistance levels based on the Fibonacci sequence. Traders look for price retracements to key Fibonacci levels as possible entry points.

The Importance of Chart Patterns in Technical Analysis

Chart patterns play a crucial role in technical analysis as they help traders identify potential trend reversals or continuations. Patterns like head and shoulders, double tops, and triangles can provide valuable insights into market sentiment and potential price movements.

Risk Management Strategies

When it comes to forex trading, risk management is crucial to protect your capital and minimize potential losses. By implementing effective risk management strategies, traders can increase their chances of long-term success in the forex market.

Calculating Position Sizes

- Determine your risk tolerance: Before entering a trade, it’s important to assess how much you are willing to risk on that particular trade. This will help you determine the appropriate position size.

- Calculate position size: Use the following formula to calculate your position size based on your risk tolerance and stop-loss level:

Position Size = (Account Balance * Risk Percentage) / (Pip Risk)

Stop-Loss Orders and Take-Profit Levels

- Stop-loss orders: A stop-loss order is a predetermined price at which you will exit a losing trade to prevent further losses. Placing a stop-loss order helps limit your risk and protect your capital.

- Take-profit levels: A take-profit level is the price at which you will exit a winning trade to lock in profits. Setting a take-profit level ensures that you capitalize on your gains before the market reverses.

Developing a Forex Trading Plan

When it comes to forex trading, having a solid plan in place is crucial for success. A trading plan Artikels your strategies, goals, risk management techniques, and how you will evaluate and adjust your approach as needed.

Components of a Comprehensive Trading Plan

- Trading Goals: Clearly define your financial goals and objectives for trading. Whether it’s to generate income, grow your capital, or hedge against risks, having specific goals will guide your decisions.

- Risk Management Strategy: Determine how much capital you are willing to risk on each trade, set stop-loss orders, and establish a risk-reward ratio to protect your investments.

- Trading Strategies: Identify the forex trading strategies you will use, such as trend following, range trading, or breakout trading. Develop a systematic approach to enter and exit trades.

- Trading Schedule: Plan your trading hours based on market volatility and your availability. Stick to your schedule to avoid impulsive decisions.

Importance of Setting Trading Goals and Sticking to a Plan

- Setting clear trading goals helps you stay focused and motivated. It gives you a sense of direction and purpose, guiding your actions towards achieving your objectives.

- Sticking to your trading plan helps you avoid emotional decisions and impulsive trades. It provides discipline and consistency, essential for long-term success in forex trading.

- Evaluating and adjusting your plan as needed allows you to adapt to changing market conditions, improve your strategies, and optimize your performance over time.

Tips on How to Evaluate and Adjust a Trading Plan as Needed

- Regularly review your trading performance against your goals and objectives. Analyze your trades, identify strengths and weaknesses, and make adjustments accordingly.

- Keep a trading journal to track your decisions, emotions, and outcomes. Reviewing past trades can help you learn from mistakes and refine your strategies.

- Stay informed about market developments, economic indicators, and geopolitical events that may impact currency prices. Be prepared to adjust your plan in response to changing market conditions.