Diving deep into the realm of 401(k) investment options, this introduction sets the stage for a captivating journey filled with twists and turns. From exploring various investment avenues to understanding the nuances of portfolio diversification, get ready for an eye-opening experience that will revolutionize your approach to financial planning.

As we delve further, you’ll uncover valuable insights and tips to navigate the complex landscape of 401(k) investment options with confidence and finesse.

Overview of 401(k) Investment Options

When it comes to 401(k) investment options, individuals have the opportunity to choose from a variety of investment vehicles to grow their retirement savings. These options allow investors to diversify their portfolio and potentially earn higher returns over time.

Types of 401(k) Investment Options

- Stock Funds: These funds invest in a portfolio of stocks, offering the potential for high returns but also carrying a higher level of risk.

- Bond Funds: Bond funds invest in government or corporate bonds, providing a more stable but lower return compared to stocks.

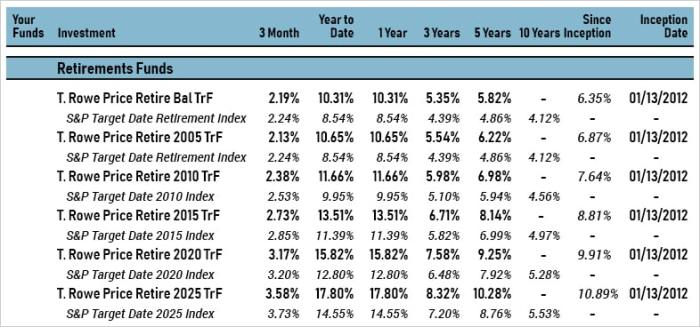

- Target-Date Funds: These funds automatically adjust the asset mix based on the investor’s target retirement date, becoming more conservative as the retirement date approaches.

- Index Funds: Index funds track a specific market index, such as the S&P 500, with lower fees and generally outperforming actively managed funds over time.

- Real Estate Investment Trusts (REITs): REITs invest in real estate properties and generate income through dividends and capital appreciation.

Importance of Choosing the Right Investment Options

Choosing the right investment options for a 401(k) plan is crucial for achieving long-term financial goals and maximizing retirement savings. It is essential to consider factors such as risk tolerance, investment time horizon, and retirement goals when selecting the appropriate mix of investments. Diversifying the portfolio across different asset classes can help mitigate risk and optimize returns over time.

Types of 401(k) Investment Options

When it comes to 401(k) investment options, there are several categories to consider. Each type comes with its own level of risk and potential for returns. Let’s take a closer look at the different types of 401(k) investment options available to you.

Mutual Funds

Mutual funds are a popular choice for 401(k) investors. They pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. This diversification helps reduce risk because your money is spread across different assets.

Target-Date Funds

Target-date funds are designed to automatically adjust your asset allocation based on your target retirement date. They typically start out with a higher allocation to stocks for younger investors and gradually shift to more conservative investments as you near retirement. This can help manage risk as you get closer to retirement.

Company Stock

Some 401(k) plans offer the option to invest in company stock. While this can be an opportunity to invest in the company you work for, it also comes with higher risk. If the company performs poorly, your retirement savings could take a hit. It’s important to carefully consider the risks before investing a significant portion of your 401(k) in company stock.

Key Factors to Consider

– Your risk tolerance: Determine how much risk you are comfortable with and choose investments that align with your risk tolerance.

– Time horizon: Consider how many years you have until retirement and adjust your investment strategy accordingly.

– Fees and expenses: Be mindful of the fees associated with each investment option, as they can eat into your returns over time.

– Diversification: Spread your investments across different asset classes to reduce risk and increase the potential for returns.

Diversification in 401(k) Investment Options

When it comes to your 401(k) investment options, diversification is key. Diversification is the practice of spreading your investments across different asset classes to reduce risk.

Strategies for Achieving Diversification

- Allocate your contributions across different asset classes such as stocks, bonds, and cash equivalents.

- Consider investing in both domestic and international markets to mitigate geopolitical risks.

- Choose a mix of low-risk and high-risk investments based on your risk tolerance and investment goals.

- Regularly review and rebalance your portfolio to ensure it stays diversified.

Benefits of Diversification in a 401(k) Plan

Diversifying your 401(k) investment options can provide several benefits:

- Reduced risk: By spreading your investments, you lessen the impact of market fluctuations on your overall portfolio.

- Potential for higher returns: Diversification can help capture gains in different market sectors, maximizing your investment potential.

- Enhanced portfolio stability: A diversified portfolio can help cushion against losses in any single asset class or sector.

- Improved long-term performance: Over time, a well-diversified portfolio can deliver more consistent returns and help you reach your retirement goals.

Monitoring and Adjusting 401(k) Investment Options

It’s crucial to regularly monitor and adjust your 401(k) investment options to ensure you’re on track to meet your financial goals. By keeping a close eye on the performance of your investments, you can make informed decisions to optimize your retirement savings.

Monitoring Performance

Tracking the performance of your 401(k) investment options is essential to gauge how well your funds are doing. Look at factors like returns, expenses, and risk levels to evaluate the overall health of your portfolio.

- Check your account statements regularly to see how your investments are performing over time.

- Compare your returns to relevant benchmarks to assess if your investments are meeting expectations.

- Consider using online tools or consulting with a financial advisor for a more in-depth analysis of your portfolio.

Adjusting Investment Options

Knowing when and how to adjust your investment options within your 401(k) plan is key to maintaining a well-balanced and diversified portfolio. Making strategic changes can help you adapt to market conditions and ensure your investments align with your risk tolerance and retirement timeline.

- Rebalance your portfolio periodically to realign your asset allocation with your target investment mix.

- Consider shifting investments based on changes in your financial goals, risk tolerance, or market conditions.

- Review and adjust your contributions to take advantage of any employer matching contributions or tax benefits.

Regular Review and Optimization

Regularly reviewing and optimizing your 401(k) investment choices is essential to maximize your retirement savings potential. By staying proactive and making informed decisions, you can ensure that your investments are working effectively towards your long-term financial goals.

- Set a schedule to review your 401(k) investments at least annually to make any necessary adjustments.

- Consider seeking professional advice or using automated tools to help streamline the monitoring and adjustment process.

- Stay informed about market trends and economic developments that may impact your investment decisions.